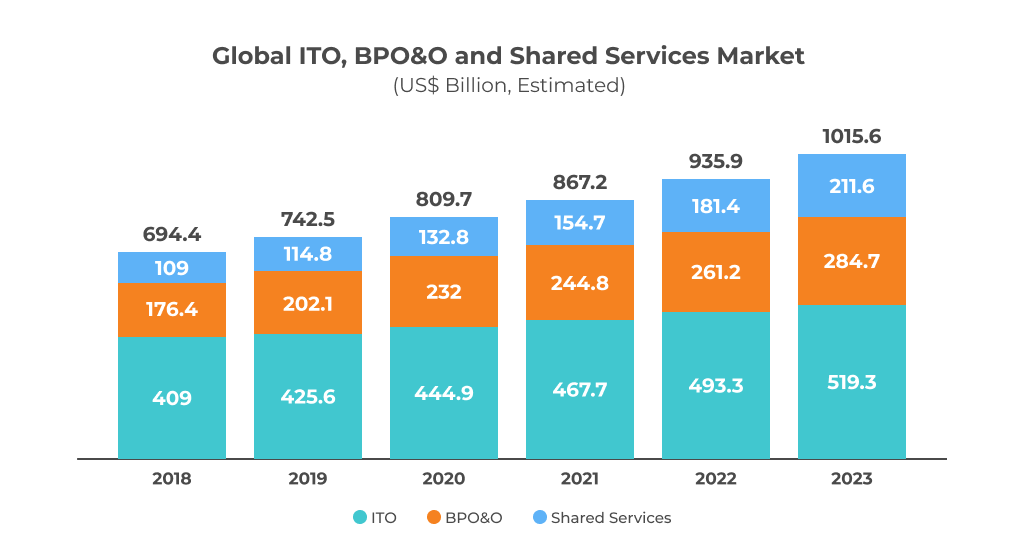

Global ITO, BPO&O, and the Shared Service Market have been steadily growing since 2018 despite the pandemic, the unstable political and global agenda, and the associated uncertainty, which have become a new norm.

Read also: Enterprise IT Trends Outlook: What to Expect in 2023-2026

According to the findings from Genesis, Gartner, and Deloitte, the market increased from $694.4 billion in 2018 to over $867 billion in 2021 and may reach $1015.6 billion in 2023. Analysts observed growth across all sectors: for example, ITO may reach $211.6 billion, BPO&O — $284.7 billion, and Shared Services — over $519 billion in 2023, compared to $154.7, $244.8, and $467.7 billion in 2021 respectively.

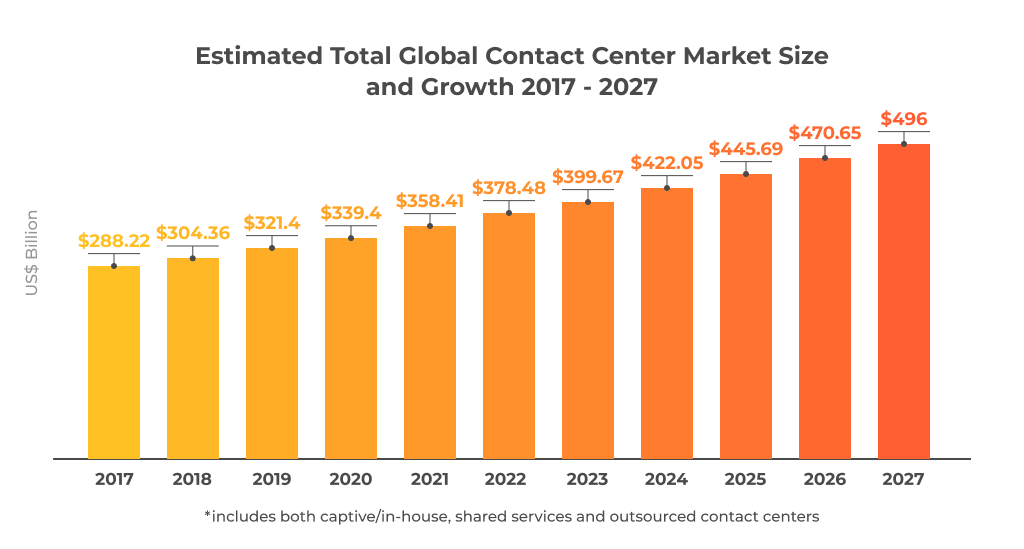

A similar trend has taken place in the global contact center market, which includes captive and in-house, shared services, and outsourced contact centers. The analysts identified significant year-on-year growth between 2017 and 2022. The market is projected to expand by 24%, from an estimated $304.36 billion in 2018 to $399.67 in 2023. In the coming five years, the market valuation may reach $497 billion, which indicates a dynamic period in the industry.

The top three regions with the greatest concentration of global contact centers are the North American region (136+ billion), Asia Pacific (109+ billion), and Europe & the UK (98 billion).

5 Outsourcing Trends to Watch in 2023

Following a booming period in the outsourcing and shared services industry, global experts have come up with five key trends that will shape sector development in the coming year.

#1. Emphasis on Quality and Value at Reduced Costs

Cost reduction is still high on the agenda. According to Genesis, 82% of global business buyers indicate cost reduction as their top outsourcing objective. Almost half of the respondents invest in innovations and enable technologies to reduce costs and improve CX (customer experience). At the same time, they start to prioritize higher-value services and performance, which can be translated into better CX and CLV (Customer Lifetime Value).

Both may be hard to achieve as, on the one side, suppliers may have to increase salaries to retain talent and, on the other side, reduce costs in the face of the coming recession. To address the challenge, both suppliers and vendors should be flexible and implement different business models based on specific output.

To meet the needs of modern buyers globally, suppliers still need to ensure proper data protection and security, which remains a top criterion for service providers and nearshore/offshore locations.

#2. Significant Shift to Total/Human Experience (HX)

The human experience is going to take a solid place in B2B communications. It can be broken into eight directions that will be rethought in 2023:

- The customer experience (CX) will become more personalized, authentic, and conscious.

- Employee experience (EX) will become as important as CX and focus on mitigating talent gap management.

- Digital experience (DX) will see greater use of web chats, email, social and messaging. Voice, however, is here to stay and will remain strong, despite the previous expectation that it would soon become extinct.

- Technology experience (TX) will deliver more innovative AI and enable tech to empower the agent desktop.

- The leadership experience (LX) will be focused on agility and addressing the global shortage of critical managerial skills.

- The social experience (SX) will gear up for new meta, AR, and VR experiential customer service interactions.

- Innovation experience (IX) will fuel greater self-service, predictive, and in-app interactions.

- The user experience (UX) will become more analytical and focused on micro-interactions across apps and websites.

#3. Multi-location and Tier 2 and 3 Strategies to Ensure Business Continuity and Resilience

According to the 2022 Buy-Side Demand Survey conducted by Genesis and GBS World Marketplace Buyers, 32% of existing global businesses that are outsourcing plan to pursue multi-location strategies in 2023 to spread their risk across several geographies. Brands are looking to diversify and expand into regions where highly skilled talent is readily available in unsaturated markets. Although the US and UK will try to move onshore, impeded by inflationary pressures, they will still consider offshore locations to mitigate risks. For example, Central and Latin America will see incremental growth from the nearshore US.

Read also: Best Regions to Source a Software Development Team

Western Europe Outlook

Eastern Europe will remain a preferred nearshore region for Western Europe. Overall, these countries performed well in 2022 and were ranked high by the 2022 Offshore BPO Confidence Index: #4 Czech Republic, #5 Poland — and they are likely to keep growing despite short freezes driven by the coming economic recession. For example, a Co-Founder at ABSL Poland said that annual industry growth in Poland was around 5-10% and may reach 10-15% by 2024/25.

Bulgaria, which was ranked #16, also observed that global companies aimed to expand their footprints across the country. Executive Director at AIBEST expects investments to focus on impact sourcing to retain talent and digital transformation in 2023. However, the country’s local, social, and political instability may become a barrier to extensive investments.

Asia Pacific Outlook

India, the Philippines, and Asia will continue to register significant growth. For example, the Philippines, which was ranked #7 by the 2022 Offshore BPO Confidence Index, focuses on higher value-added services, together with country-wide regulations and government support, to accumulate higher investments in the region. There is a trend to shift from Tier 1 cities to Tier 2 and Tier 3 cities with an aim to promote a tech ecosystem across the country. According to the Genesis findings, 34% of global outsourcers and businesses are considering the same strategy not only to mitigate risks but also to access talents.

Malaysia is also registering stable growth, with a 6.2 CAGR in the next five years. Experts anticipate a significant revolution in IT services and DBS in the coming years. They expect 2023/24 to be a transitory phase and 2025 to see new highs for growth. Security, which is a top priority when looking for tech vendors, is high on the agenda across the country.

South Africa Outlook

Africa will be considered the next GBS/BPO frontier. Industry experts believe that the youth talent and consumer pools, collaborative nature, and governmental support will allow South Africa to become a high-quality, affordable English-speaking CX destination. According to the 2022 Ryan Strategic Advisory Front Office CX Omnibus Survey, Africa was ranked as a preferred offshore CX destination in 2022, together with India.

#4. Hybrid Working As the ‘New Normal’

GBS organizations eagerly adopt new multiple hybrid virtual and physical work models. The most popular option (31%) is a combination of 3 days on-site and 2 days at home. Next comes (25%) 2 days on-site and 3 days at home, as well as (17%) 1 day on-site and 4 days at home. Some governments, like the Philippines, acknowledge the trend and support private and public companies to enable hybrid work conditions.

Still, 10% prefer the absolute on-site model, and only 2% are total remote work advocates. This means that despite the trend for hybrid workplaces, the choice depends on the individual needs, risks, and service requirements of clients in different vertical industries.

#5. The Surge in Outsourcing from Businesses to SME Providers

Small businesses are going to actively engage in the industry in 2023. According to GBS World and Genesis Global Business Services, 87% of small US businesses plan to outsource a business process in 2023. This will promote growth in MSPs (Managed Service Provider) platforms for SMEs to grow and scale collectively. For example, 5 SME outsourcers may be able to cater to the needs of a single enterprise.

This will lead to source market players aiming to merge or acquire small and medium BPOs and ITOs. Overall, the trend is also powered by large business needs: over half of enterprise buyers look for more boutique providers, hubs, and small-scale delivery centers.

Summing Up

The global ITO, BPO&O, and Shared Service Markets are likely to witness growth in 2023 despite the coming recession. However, industry players must acknowledge and adapt to new customer demands, where quality, value, human experience, and cost reduction are on the agenda. Offshore CX destinations will keep acquiring investments, yet the decision-making process may become longer, considering the tough economic situations and uncertainty. For example, experts admit that in the past, it took around 6 months to decide, whereas, in 2023, it may take up to 12 months.