Recently due to the proven productivity and cost-efficiency of Robotic Process Automation (RPA) solutions the usage of those technologies has significantly increased. Previously, we have provided information regarding successful outcomes brought about by RPA adoption by the world’s leading financial institutions. Nevertheless, there is a possibility of an appearance of some difficulties throughout the digitalization process, which has a negative impact on achieving the successful implementation of the RPA technologies.

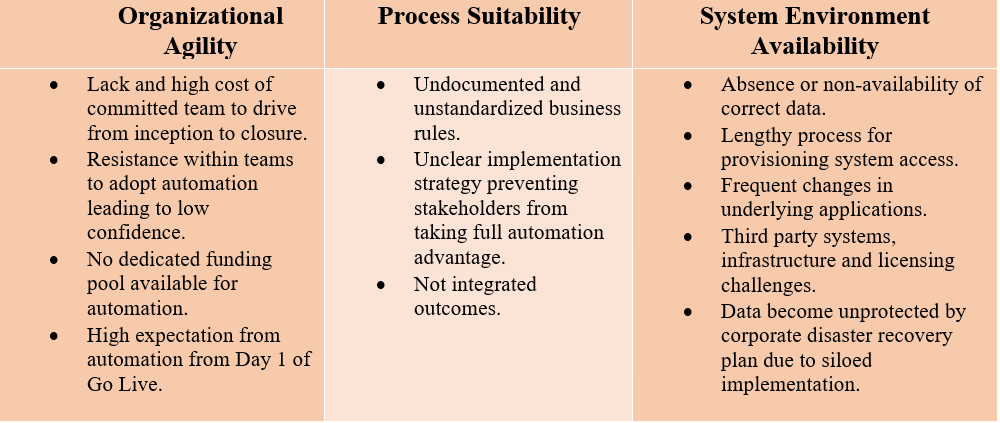

While analyzing information about automation solutions implementation, three levels of challenges could be outlined: organizational, process and challenges associated with the system environment. The table below shows the main difficulties which any organization may face during the adoption of the RPA solutions in more detail.

Mostly, planning to apply automation technologies, companies usually have unclear implementation strategy which includes non-defined problems that are necessary to fix. The standardization and centralization of the processes along with decreasing the equivalent of FTE brought about by RPA usage reduce companies’ costs. Nevertheless, the adoption of small-scale solutions (due to processes not ready for widespread implementation throughout a company) causes overestimated cost savings for businesses and weakens them to continue to meet business opportunities. Often, companies apply approaches like Business Process Management (BPM) and Process Transformation along with RPA which partly meets the challenges of the business environment suitability. Additionally, the major problem that organizations face is the lack of professional approaches in the adoption of RPA solutions which eventually results in their inefficient implementation.

However, digital transformation plays a crucial role in modern society and has a significant impact on the financial services industry. While choosing to keep abreast of automation, enterprises should realize the technological and organizational challenges that they will have to meet. The following image represents key elements of the successful implementation of the RPA technologies, which is an essential part of the overall strategy of organizations’ Digital Transformation.

Before starting the transformation, it’s crucial to realize the main purpose of digitalization. In this regard, it is necessary to deeply research the appropriate area to determine the main trends and demands for Digital Transformation in general and certain RPA solutions in particular. That makes companies possible to create correct digital platforms, which will allow applications to produce required outputs. This approach is the base of a successful transformational process.

After establishing goals, enterprises can develop a transformational strategy, which includes a centralized approach as well as cognitive computing, advanced analytics, and further adoption. One of the world’s leading institutions, Deutsch Bank used such a strategy that comprised RPA application incorporated with cognitive capabilities and machine learning. It made it possible for RPA technology to automate issues according to the specific rules, whereas certain algorithms handled detailed work such as the specification of the document types or scanning unstructured information. Those improvements allow the bank’s experts to be engaged in solving more complex tasks which dramatically increase productivity and quality of the bank’s services.

The successful implementation of the RPA solutions directly depends on effective collaborative outsourcing to third-party organizations. Productive cooperation includes appropriate restructured business management accompanied by relevant and beneficial outsourcing. Such an approach was adopted by another global financial institution, Dutch bank ING, which invested funds into the redevelopment of their business model and arranged interconnected goals. At the same time, the bank cooperated with a vendor that has developed a platform that collects information from social media and combines it with banking data. The technology also assesses the companies’ credit capacity and affords the higher possible loan to those clients. In terms of the high demand for digitalized services, the bank has significantly increased the number of its clients due to those transformations.

As mentioned examples show, the implementation of RPA solutions has a significant impact on business development, particularly in the financial services industry. It drives numerous benefits such as staff advantages, improved business performance, and quality advancements. However, despite the mentioned avails, some difficulties arise during the adoption of RPA technologies: the unclear strategy of implementation as well as the lack of professionals and the widespread adoption of technology. Nevertheless, advanced analytics coupled with platform and design thinking will create a competitive advantage for financial institutions in the future. Those drivers will work most effectively in collaboration with outsourcing companies able to cover all aspects of the digital transformation process. That makes companies possible to dramatically improve their capabilities by expanding the automation process throughout enterprises.